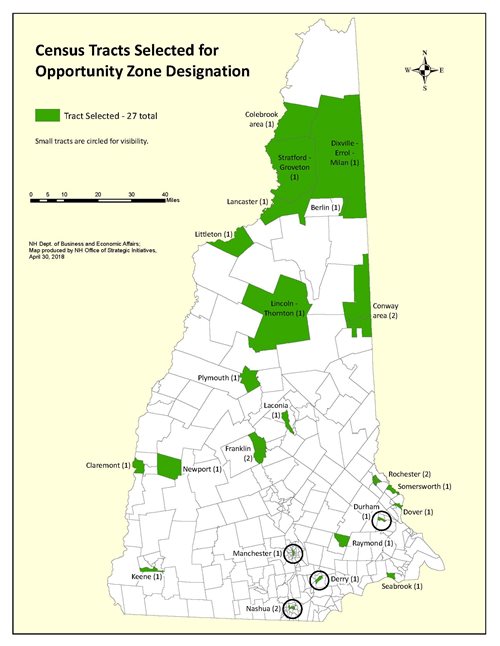

Opportunity Zones in New Hampshire

Following creation of the federal Opportunity Zone program in 2018, 27 census tracts around New Hampshire were nominated for inclusion.

Opportunity Zones encourage economic development and investment in low-income areas around the country.

Investors can defer capital gains on earnings that have been reinvested in the zones through Opportunity Funds, which are private sector investment vehicles that invest at least 90 percent of their capital in Opportunity Zones. Long-term investments maintained for over 10 years do not have to pay additional capital gains taxes on earnings from Opportunity Zone investments.

Explore New Hampshire's Opportunity Zones by county and by municipality.

See

frequently asked questions for more information.